It’s a tool for planning how much you’ll accumulate by consistently contributing to a retirement plan or understanding the total repayment amount for a loan with regular installments. The future value tells you how much a series of regular investments will be worth at a specific point in the future, considering the interest earned over time. If you’re interested in selling your annuity or structured settlement payments, a representative will provide you with a free, no-obligation quote.

Rate Per Period

- The dollar received at the end of year 3 must be discounted back 3 periods; the dollar received at the end of year 2 must be discounted back 2 periods; and so forth.

- Treasury bonds are generally considered to be the closest thing to a risk-free investment, so their return is often used for this purpose.

- Rent is a classic example of an annuity due because it’s paid at the beginning of each month.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Assuming that the term is 5 years and the interest rate is 7%, the present value of the annuity is $315,927.28.

The image is of a black Texas Instruments BA II Plus financial calculator. The calculator has a large LCD screen at the top which is displaying the number “0.”. Below the screen, there is a keypad with numerous buttons divided into several rows. The buttons provide various financial calculations and standard calculator functions. We can therefore use the Present Value of an Annuity formula to estimate the Present Value of this cash flow stream.

Formula and Calculation of the Present Value of an Ordinary Annuity

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. By calculating the present value, you can understand the effective cost in today’s dollars, potentially helping you with budgeting or financial planning.

Present Value of an Annuity Formulas

A common variation of present value problems involves calculating the annuity payment. This table is constructed by summing the individual present values of $1.00 at set interest rates and periods. On the other hand, the future value of an annuity will be greater than the sum of the individual payments or receipts because interest is accumulated on the payments. As a reminder, this calculation assumes equal monthly payments and compound interest applied at the beginning of each month.

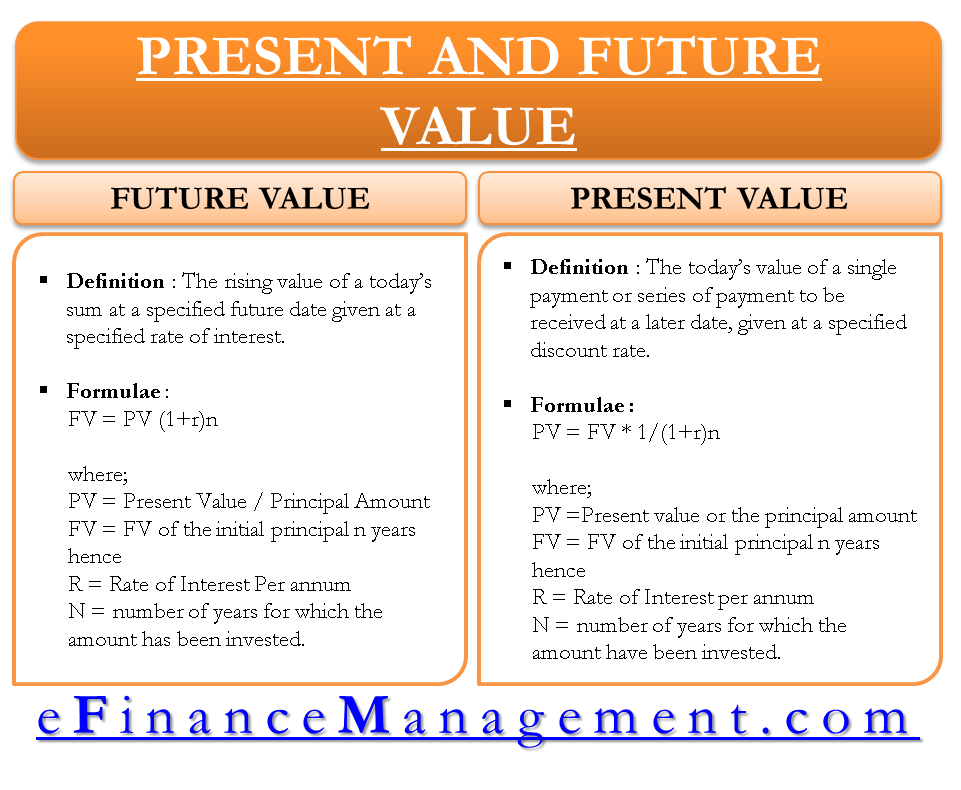

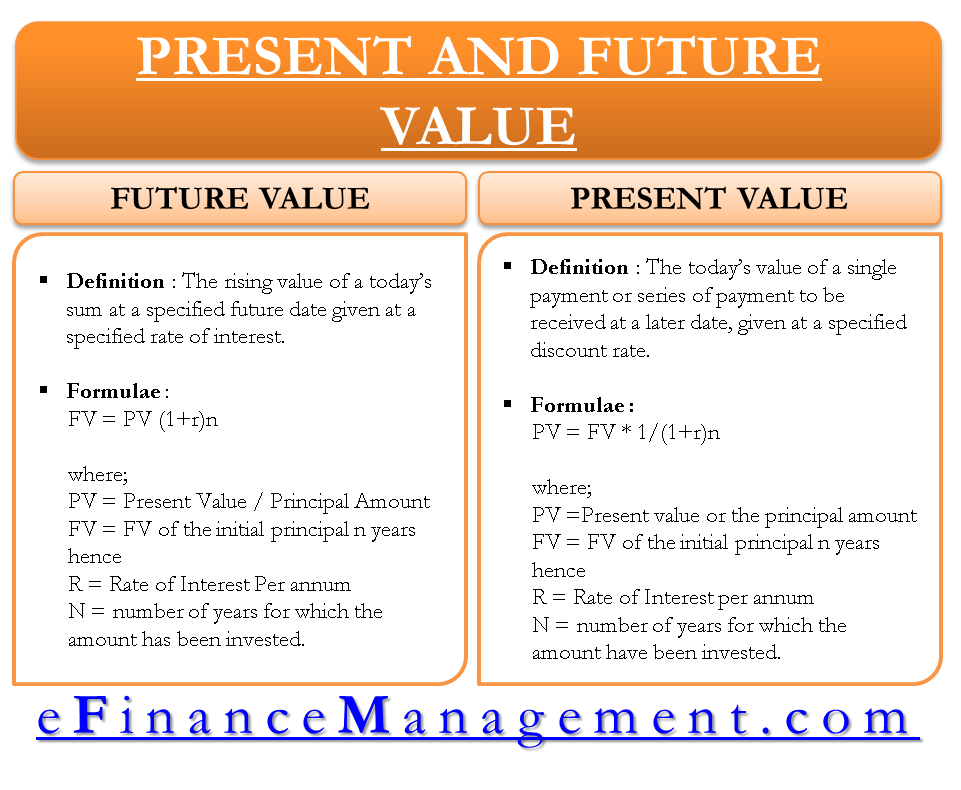

The discount rate is an assumed rate of return or interest rate that is used to determine the present value of future payments. Present value is an important concept for annuities because it allows individuals to compare the value of receiving a series of payments in the future to the value of receiving a lump-sum payment today. By calculating the present value of an annuity, individuals can determine whether it is more beneficial for them to receive a lump sum payment or to receive an annuity spread out over a number of years. This can be particularly important when making financial decisions, such as whether to take a lump sum payment from a pension plan or to receive a series of payments from an annuity. When a finance company purchases a loan contract from another organization, it is essentially investing in the future payments of the loan contract.

Types of annuities

An ordinary annuity is a series of equal payments made at the end of consecutive periods over a fixed length of time. An example of an ordinary annuity includes loans, such as mortgages. The payment for an annuity due is made at the beginning of each a timeline of the allegations against ellen degeneres and her producers period. This variance in when the payments are made results in different present and future value calculations. This formula is commonly used in corporate finance and banking, but is equally useful in personal or household financial calculations.

Similarly, the formula for calculating the PV of an annuity due takes into account the fact that payments are made at the beginning rather than the end of each period. As mentioned, an annuity due differs from an ordinary annuity in that the annuity due’s payments are made at the beginning, rather than the end, of each period. An annuity is a financial product that provides a stream of payments to an individual over a period of time, typically in the form of regular installments. Annuities can be either immediate or deferred, depending on when the payments begin.

In just a few minutes, you’ll have a quote that reflects the impact of time, interest rates and market value. Annuity.org partners with outside experts to ensure we are providing accurate financial content. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The best way to demonstrate the strengths of the annuity calculator is to take some annuity examples. If pencils and scrap paper aren’t your thing, you could make life easier by entering your present value of annuity formula into an Excel spreadsheet. Present Value of Annuity Excel formula can be set up by clicking the fx button then picking the “Finance” category and the “PV” or present value function. There are all sorts of different ways to pinpoint the present value of an annuity. That includes everything from talking to an independent insurance agent, reviewing an annuity table, or even just busting out the old pen and paper and tackling it high school math style.

Although you could use this technique to solve all future value of an annuity situations, the computations become increasingly cumbersome as the number of payments increases. In the above example, what if the person made quarterly contributions of [latex]\$250[/latex] for three years? That is [latex]12[/latex] payments over three years, resulting in [latex]11[/latex] separate future value calculations. Or if they made monthly payments, the [latex]36[/latex] payments over three years would result in [latex]35[/latex] separate future value calculations! Clearly, solving this would be tedious and time consuming—not to mention prone to error.

You now know how to calculate Present Value of an Annuity using the formula and the annuity discount factor. The Present Value is the value of future cash flows expressed in today’s terms. Spreadsheets such as Microsoft Excel work well for calculating time-value-of-money problems and other mathematical equations. You can type the equation yourself or use a built-in financial function that walks you through the formula inputs. You can find the PV of an ordinary annuity with any calculator that has an exponential function, even regular (non-financial) calculators.